Investment Commentaries: Interim First Quarter 2017

Midway through the first quarter and a month into the Trump presidency, equity markets (both domestic and international) have continued barreling upward. At our firm’s most recent investment committee meeting last Thursday, much of our discussion revolved around a few core issues, which I will summarize below.

Our Investment Committee meeting occurs monthly, and is our opportunity to gather the entire team together with a singular focus on making client portfolios better. We spend time separately and collectively throughout the month researching and analyzing markets and securities, as well as meeting with our clients and hearing their perspectives. When we come together for our monthly committee meeting, each of us brings valuable observations, questions, and information. Our objective is to end the meeting with a cohesive view of the current market environment in relation to client portfolios, and an understanding of what actions we must take to make sure that view is reflected in portfolios. Here is a summary of key takeaways from our meeting last week.

1. What are indicators saying about the health of the economy and market sentiment?

In short and on balance, things are looking up. Consumers are spending more; unemployment is down even as more workers re-enter the job market; and demand is exceeding expectations in aggregate for businesses’ products and services. All of this is occurring as inflation remains tame, which bodes well for continued improvement. In addition, the Treasury yield curve (which measures the difference in yields between short-dated and longer-dated treasury bonds) is steepening, which typically signifies the expectation for stronger economic performance in the future.

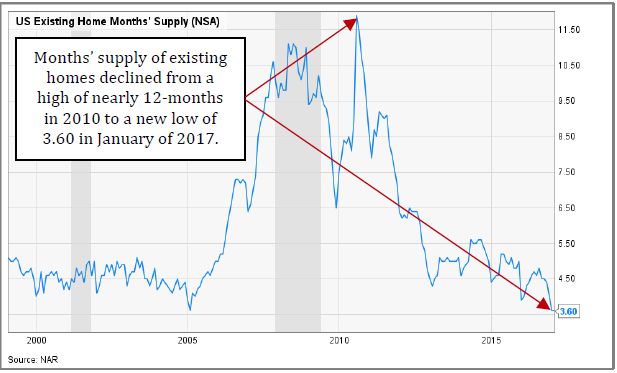

Corporate bond yield spreads (the difference between yields on corporate bonds and comparable maturity treasury bonds) have also declined significantly over the past year, which indicates a broadly positive view on the strength of corporate credit. One more anecdote: the inventory of existing homes for sale is currently 3.6 months’ worth, which is below the previous low of 3.9 in 2004. Who would have thought even 5 years ago, that this would be the case?

2. What are valuation indicators saying about where prices are relative to drivers of value?

At first blush, strong market performance is no surprise given the current strength of the economy. But, the economy has shown similar signs of improvement before, with no corresponding strength in the markets. As a recent example, productivity, personal consumption, and the labor market showed significant improvements in 2015, but the only segment of US stocks that delivered positive returns were large-caps, which returned 1.3% for the year including dividends. The difference this time is the market’s belief that economic momentum can be sustained with the help of the new administration’s actions on issues such as tax reform and de-regulation.

We discussed our concerns regarding this perception in our last commentary, and not much has materially changed except the unrelenting increase in market price levels. This is one reason why it is and will always be important to remain aware not only of price, but also price relative to fundamental drivers of value. By most measures, markets are at least fairly-valued, and by a few measures over-valued. For example, the accompanying chart of price relative to earnings-estimates for the next twelve months as of January 31st, shows most segments of the equity markets near their 10-year highs, and all of them above their 10-year averages.

There are arguments that even though indicators like price-to-earnings indicate overvaluation, this time is different because inflation and interest rates are so low. Even assuming that these arguments have some merit, we must prepare for the fact that interest rates and inflation change, and that they are more likely to move higher than lower if the economy continues to gain momentum. On the other hand, if rates remain lower due to a deterioration in momentum and a continuation of lower economic growth, then prices will adjust downward to reflect poorer business conditions. Either way, continuing to expect higher prices with no change in the underlying fundamentals is unrealistic. From experience and market history, we know that markets can remain over or undervalued for some time, but if fundamental conditions do not at some point catch up to expectations reflected in prices, prices will adjust accordingly.

3. What are we doing to prepare client portfolios for the possibility of a downturn in the equity markets, while not limiting exposure to strong upward movements in price in the meantime?

We believe this is the question most investors should be asking right now. No one wants to miss out on market upside in a bull market, but the challenge is to measure the benefits of remaining invested against the cost of participating in an eventual downturn. Sir John Templeton famously posited, “Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.” It would be hard to argue that markets are anything but optimistic; which simply means they are hoping for the best. Hope is a good thing in many areas of life, but it is certainly not a pillar of our investment process. The issue at hand is one of uncertainty, and we manage for uncertainty in a few distinct ways:

- Asset Allocation: Our clients’ portfolios do not behave like the stock market because they are diversified across non-correlated asset classes that include but are not exclusive to stocks. This means that when stocks decline sharply in price, other areas of client portfolios should decline less and in some cases, increase in value.

- Portfolio Rebalancing: Many of you are aware that we systematically rebalance portfolios. This means we do this at regular intervals no matter the condition of the stock market. Generally, this helps us buy holdings at lower prices, and sell them at higher — a win by any measure. In the current stock market environment, you will generally see us selling more stocks as opposed to buying them. This is evidence that the process is working. We do not believe that timing the market is an effective way to manage portfolios to meet client objectives over the long term. The purpose of timing the market is to guess when stocks will increase or decrease in price, and buy or sell based on that guess. Rather than buy or sell based on our best guess of market behavior, we rebalance to take gains on outperforming areas of the portfolio and reinvest proceeds into more under-appreciated investments. Over time, this limits portfolios’ exposure to overheated asset classes, and maintains allocations to assets that may be out of favor temporarily, but remain fundamentally sound.

- Cash: We see cash as an asset class, which means that we allocate a portion of the portfolio to it. As portfolio managers, we have an almost-instinctive urge to raise cash by selling stocks when markets are approaching an overvalued state. This often frustrates clients who see cash accumulating when markets seem to be moving up. As we said earlier, markets can remain over/under valued for long stretches. For example, markets driven by “irrational exuberance” in the late 1990’s remained at elevated levels long-after many credible investors had labeled it a bubble. Similarly, it took markets six years after lows reached in 2009 to climb to levels that most are comfortable acknowledging as fairly-valued.

That said, just like any other asset class cash will not represent a concentrated proportion of the overall portfolio, and it will be subject to rebalancing. It can be disappointing to see cash in portfolios when markets are performing well, but in times of high market volatility, cash reduces risk and provides “dry powder” to buy undervalued securities opportunistically, and rebalance into broader asset classes and categories from time to time when investors broadly overact to bad news by indiscriminately selling positions. We saw at least 3 of these indiscriminate selling tantrums in 2016 (see our year-end commentary for the chart that details these episodes), and if you check your trading confirmations, you will see that we stepped into most of those with equity buys using cash we already had, not cash from selling existing holdings into the short-term weakness.

- Security Selection: We strive to buy and hold securities within asset classes that are priced at or below their intrinsic value. In the case of stocks, this means securities of companies that are priced to take into account higher risk, lower profitability, and/or lower growth than we think is warranted given our analysis of the company. Sometimes, this difference in price and value can occur more broadly at the industry, sector, and even asset-class levels. We have our eyes on a few of these dislocations, both on the high end (overpriced: consumer-defensives and basic materials) and the low end (underpriced: energy). We approach our analysis of these situations thoughtfully and seriously as part of our duty to clients.

As markets continue to adjust expectations relative to the unfolding realities of the new administration, we want you to know what we are doing to make sure your portfolios are positioned for the volatility of the near-term insofar as it can impact your long-term objectives. If you have questions or concerns regarding your investments, we hope that you will share them with us either by calling or emailing us, or during our next quarterly meeting. We appreciate the trust you place in us, and we look forward to seeing you soon.

Matt A. Morley, CVA, CEPA

Chief Investment Officer