Investment Commentaries: Fourth Quarter 2016

| Index Returns | 4th Quarter | Trailing 12 Months |

| S&P 500 US Large Cap Index | 3.95% | 12.00% |

| MSCI All Country World Stock Index | 1.05% | 8.40% |

| Barclays Capital Aggregate Bond Index | -3.12% | 2.41% |

| US Core Consumer Price Index - (Inflation) | 0.39% | 2.06% |

2016 was a very eventful year for markets, and looking forward we see no shortage of catalysts for a dynamic 2017 to follow. In this quarter’s investment commentary, we look back on 2016 in light of market behavior following the year’s major events, and we discuss how we have positioned portfolios for the opportunities and risks that we see for 2017 and beyond.

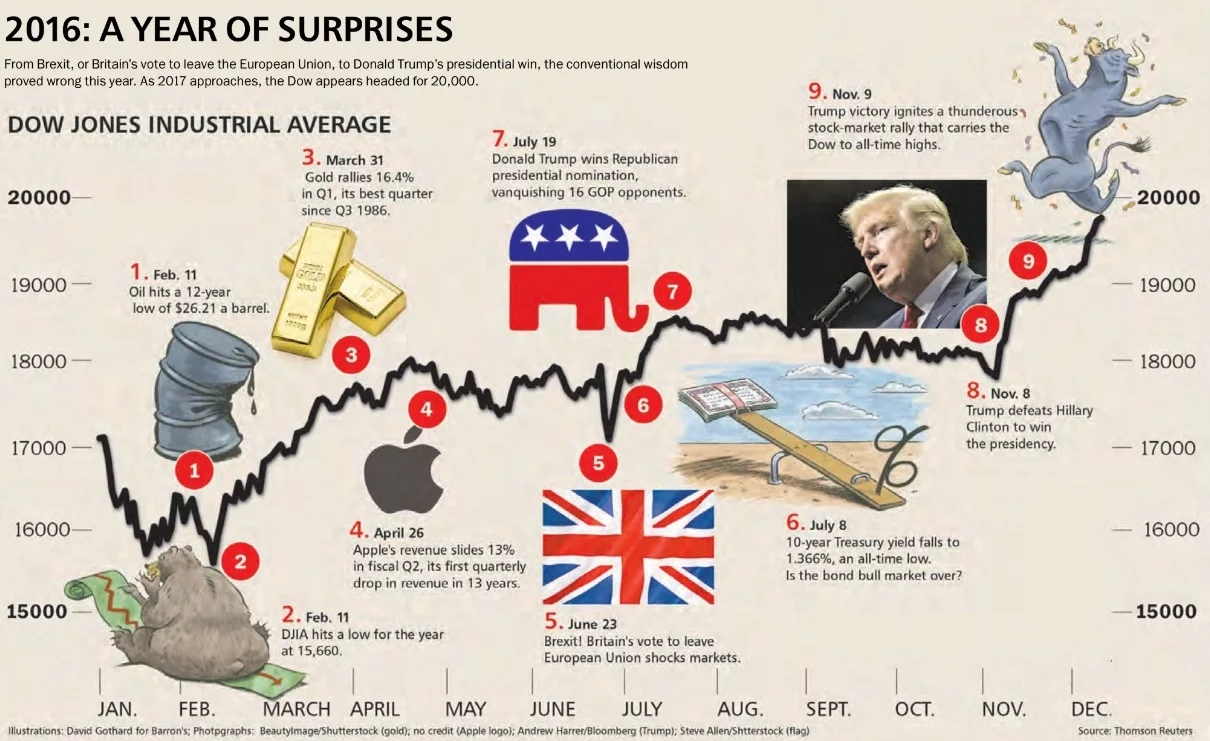

2016 In Review: When we look back on 2016, the most impactful event that comes to mind is the election of Donald Trump as the next President of the United States. Indeed, the market reaction to the election result was significant and almost as surprising as the election result was. But, the chart below from Barron’s magazine does a great job of reminding us of some other events that helped shape the year.

What the Barron’s chart does a poor job of, is highlighting how those events impacted investments other than large-cap US stocks. For example, the chart below illustrates how the same events impacted markets for precious metals (gold, silver, and platinum), and bonds (US Treasury securities, corporate bonds, municipal bonds, etc.).

The two charts illustrate what we observed across asset classes:

- Pre-Election: More of the same pattern of behavior that began in late 2013 - slow but steady markets interrupted by small bouts of volatility followed by a swift return to pre-interruption price levels.

- Post-Election: A significant decline in aversion to risk, and a flight away from investments with objectives of low volatility and/or inflation-protection.

In short, after the election we observed the swift impact of the expectation of a meaningful change in economic and financial market conditions. For stocks in particular, there are at least three mindsets that explain how the change in expectations impacted asset prices as significantly as they did. We believe all three have been at work:

Mindset 1 - Slow Down the Ship

Many investors believe the regulatory environment built over the past eight years was hampering growth at both the macro-economic and the industry/company level. Their conclusion would be that simply stopping the momentum of additional regulatory constraints will lead to the return of growth and prosperity.

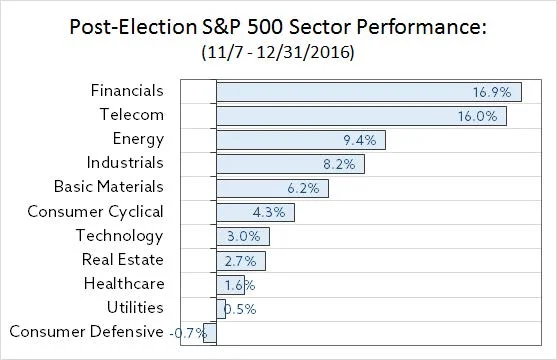

A stark example of this is the performance of the Telecommunications and Financials sectors within the S&P 500; two of the most heavily regulated sectors that have been the focus of significant government scrutiny in recent years. Both increased by over 16% between November 7th and December 31, while the overall index increased by 5.5% over the same time-period.

Mindset 2 - Turn the Ship Around

Many of those same investors believe that the new administration will not only slow additional regulatory hurdles, but will also lead a wave of de-regulation and pro-business policies that will drive even stronger economic growth over the next few years.

Mindset 3 – Fear of Missing Out

Many investors do what they think everyone else is doing, regardless of why they might be doing it, perpetuating and exaggerating changes in the market.

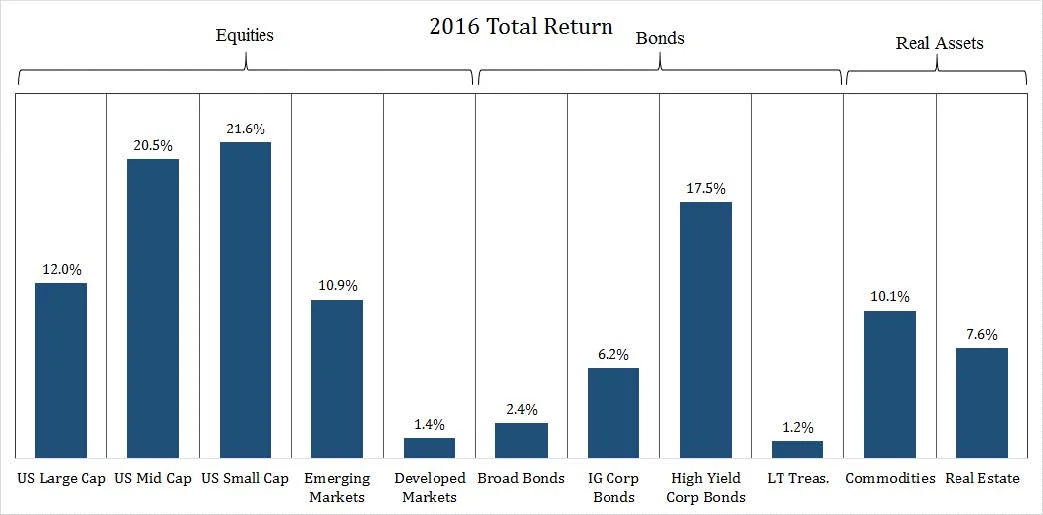

For the year, returns for most investment categories across major asset classes were positive; some with a significant proportion coming in the post-election rally. We regularly measure 11 such categories, all of which exhibited positive returns for the year (see the chart below).

Over the preceding 10 years, 2010 was the only other year in which the returns for all categories were positive.

Regardless of the likelihood or legitimacy of the change in expectations behind the strong performance of stocks and other risky assets after the election, the result is that to some extent markets have essentially taken out an advance against future returns. How much of an advance it is relies heavily on the successful realization of the first two mindsets outlined above. The further markets increase without evidence that new expectations are realistic and successful in stoking the economic fire, the more of an advance in returns investors will be taking against the future. That said, equities in aggregate are not significantly overvalued on a fundamental basis relative to historical levels, which in our view reduces the likelihood of a severe and sustained market downturn (i.e. greater than 20% decline).

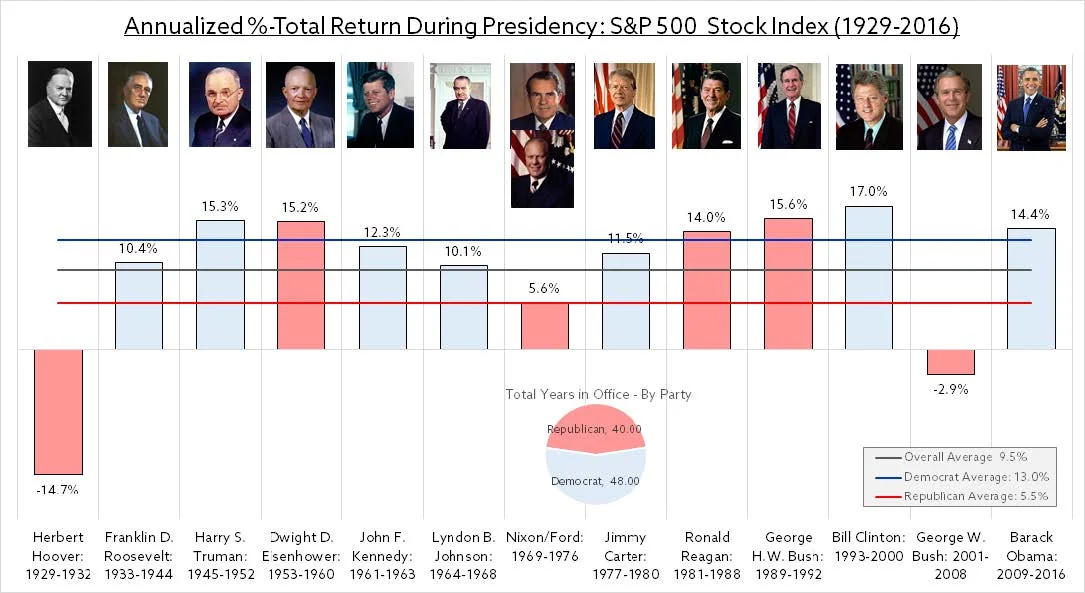

Though anecdotal, it is interesting to evaluate expectations of improved market conditions tied to the incoming administration against market performance during previous presidencies (see chart below). We do not place much weight on this information, but we do have one important takeaway: Over the long-term, market return and more importantly portfolio performance depend on much more than who is in the oval office.

The majority of our clients’ portfolios are diversified across multiple asset classes according to their risk-tolerance and long-term objectives. Trading activity in those portfolios reflected the views we described above over the quarter. For example, client portfolios benefited after the election from positions in the financials and industrials sectors we initiated in late October.

Additionally, as bond prices declined post-election, we found opportunities to add to fixed income allocations in portfolios at more reasonable price-levels and higher yields, while limiting credit risk. We also continued systematically rebalancing portfolios to maintain target allocations across asset classes and sub-categories.

We look forward to further discussing these and other recent changes within your portfolio, as well as portfolio positioning in general when we next speak with you. We do not take lightly the trust you place in us as your advisors and look forward to meeting with you soon.

Matt A. Morley, CVA, CEPA

Chief Investment Officer